The cosmetic packaging market in the Asia-Pacific region is moderately competitive, featuring established companies as well as new entrants. Reputable companies in the industry are leveraging their manufacturing and R&D capabilities to drive innovation and maintain their competitive positions in the market.

- APAC Cosmetic Packaging Market Analysis

- APAC Cosmetic Packaging Market Trends

- Market Potential of the Cosmetic Packaging Industry in Vietnam

I. APAC Cosmetic Packaging Market Analysis

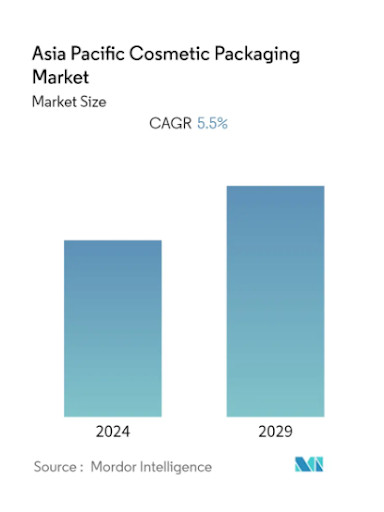

The Asia-Pacific cosmetic packaging market is projected to achieve a compound annual growth rate (CAGR) of 5.5% over the forecast period. This market size represents the value of packaging used in the cosmetics industry across countries in the region. The cosmetics industry demands a wide variety of packaging materials, including metal, paper, glass, and plastic, to create containers, bags, cartons, tubes, droppers, syringes, and other flexible packaging solutions.

The cosmetics industry in the region is driven by the rise of dynamic consumer groups in economies such as China, India, Japan, and Indonesia. Factors like increasing beauty awareness, affordable cosmetics, and the growth of e-retail have boosted the consumption of cosmetic products in the region. Market participants are focusing on producing innovative and attractive packaging to make their products stand out against competitors.

Additionally, factors such as rising disposable income, affordable cosmetics, the popularity of skincare products made from natural and organic ingredients, along with the development of e-commerce, are also driving the demand for cosmetic packaging in the region. The Asia-Pacific region is expected to enhance packaging volumes in the cosmetics industry due to increasing disposable income and the strong penetration of smaller, affordable plastic packaging sizes.

Demographic changes in the region also positively impact the demand for natural ingredients in cosmetics. The aging population in countries such as South Korea, China, and Japan is increasing the demand for products with natural ingredients featuring anti-aging properties.

Paper cosmetic packaging is experiencing strong growth in the region. Many Asian and international brands have launched paper packaging products to meet the growing consumer demand for sustainable packaging. Paper packaging is often used in secondary and tertiary packaging, as cosmetics contain 70% to 95% water, making paper less commonly used as primary packaging. However, some companies have started introducing products using innovative paper packaging. For example, in November 2021, WOW Skin Science launched its first Vitamin C Face Wash in a paper tube. The paper used in this packaging is certified by the Forest Stewardship Council, with high burst strength and low COBB value, ensuring durability and stability even in wet conditions.

The spread of COVID-19 negatively impacted the market due to disrupted supply chains and prolonged factory closures. However, increasing awareness of sustainability and concerns about the impact of plastic on the planet, health, and environment may hinder market growth. Nonetheless, plastic remains one of the most preferred materials in cosmetic packaging, in various forms such as primary containers, secondary flexible bags, caps, and sprayers. This is expected to drive growth for the cosmetic packaging market.

II. APAC Cosmetic Packaging Market Trends

A. Plastic Packaging Expected to Drive Market Growth

Plastic is one of the most popular and preferred materials in cosmetic packaging. Many cosmetic products today use plastic bottles and containers due to their ease of molding, flexible structure, diverse design capabilities, and good protection.

Plastic bottles and containers have dominated the market share in the cosmetics industry over the past five years without facing significant competition. According to a National Geographic study, the use of plastic packaging in the cosmetics industry today has increased more than 120 times compared to 1960.

Plastic packaging is widely used in personal care products, such as cosmetics and personal hygiene items. For complex cosmetics like special oils, vitamins, and herbal compounds, plastic packaging helps protect the product from light and contamination while extending its shelf life. Therefore, multi-layered plastic barrier films and flexible barrier packaging are used to meet these requirements.

In March 2021, Garnier announced that it would stop using virgin plastic for all packaging by 2025. Garnier also stated that its factories and production units would be carbon neutral by 2025 and would use reusable, recycled, or compostable materials in all its packaging, under the Garnier Green Beauty sustainability program, saving 37,000 tons of plastic annually.

Chinese beauty brands are also innovating sustainable cosmetic packaging solutions. For example, in July 2022, Top Cosmetics launched core facial care products with packaging made from Eastman’s Cristal Renew copolyester, containing 50% certified recycled content. This packaging development stemmed from close collaboration between onTop, WWP Beauty, and molecular recycling company Eastman.

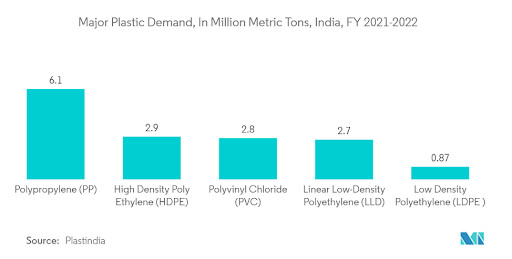

According to Plast India, the demand for polypropylene (PP) reached approximately 6.1 million tons in 2021-2022, while the demand for high-density polyethylene (HDPE) and polyvinyl chloride (PVC) was 2.9 million tons and 2.8 million tons, respectively.

B. Chinese Cosmetics Market: Growth and Trends

The cosmetics market in China has developed rapidly in recent years, driven by the rise of consumers. Consumer spending on cosmetics continues to increase, facilitating the trend of using processed, packaged, and premium products. Skincare and makeup cosmetics are growing strongly, with facial and medical skincare witnessing strong demand. Additionally, anti-aging and anti-pollution products also have significant growth potential.

The State Administration for Market Regulation of China (GB 23350-2021) announced in March 2021 that there would be a revision to the existing packaging standards, effective from September 2021. Cosmetics companies have two years to redesign their packaging to comply with this new standard, which is expected to take effect in September 2023. The new standard aims to control excessive packaging, creating short-term challenges but promoting sustainability in the long run.

The trend of sustainable beauty is driving cosmetic companies to develop more ecological solutions for consumers. Many Chinese cosmetics brands have shifted to sustainable packaging due to government regulations. For example, in July 2022, onTop launched packaging made from Eastman’s Cristal Renew copolyester with 50% certified recycled content.

Due to the growing demand for paper packaging, global companies are also investing in China. For example, in June 2021, Huhtamaki acquired Jiangsu Hihio-Art Packaging Co., Ltd., a China-based manufacturer of paper bags, wraps, and folding cartons. These developments are expected to spread within the paper packaging sector for cosmetics.

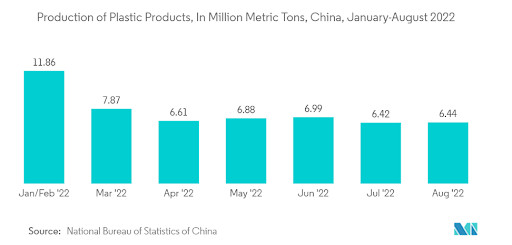

Additionally, China is the world’s largest producer of plastics, accounting for nearly one-third of global plastic production. According to the National Bureau of Statistics of China, the output of plastic products in December 2021 was 7.95 million tons, the highest since January 2020.

3. Market Potential of the Cosmetic Packaging Industry in Vietnam

The cosmetics packaging market in Vietnam is experiencing strong growth, driven by the rapid rise of the middle class, which is expected to make up 26% of the population by 2026. This growth has created an increasing demand for health and beauty products, thereby boosting the cosmetics packaging market. The preference for natural and safe products, along with the trend of consumers willing to pay more for premium brands, is encouraging businesses to innovate and design creative packaging to attract consumers.

Additionally, the development of the digital economy in Vietnam, which is expected to account for 13% of the digital economy market in Southeast Asia by 2025, has opened up new distribution channels such as e-commerce, home delivery, and social media. This requires businesses in the packaging industry to quickly adapt and develop suitable, convenient, and attractive packaging types for each distribution channel.

Vietnam’s international integration through free trade agreements like CPTPP, EVFTA, and RCEP also presents significant opportunities for the cosmetics packaging market. Vietnamese businesses can expand their export markets, collaborate with foreign partners, and access new technologies, thereby improving product quality and competitiveness.

In the context of the Asia-Pacific region’s focus on innovative and sustainable packaging, Vietnam has the potential to become a promising market. With the global trend towards sustainability and increasing interest in environmentally friendly packaging, domestic companies can seize this opportunity to grow and establish their position in the international market.

The cosmetic packaging market in the Asia-Pacific region is experiencing strong growth, with a focus on innovative and sustainable packaging, especially in dynamic economies like China, India, Japan, and Indonesia. The trend towards using recycled and eco-friendly packaging is gaining momentum, although plastic remains a common material. Companies are redesigning packaging to minimize over-packaging, promoting sustainability. In Vietnam, the cosmetic packaging market is also growing rapidly, driven by a rising middle class and a preference for natural, safe products. Businesses are shifting towards sustainable packaging, benefiting from the digital economy and international free trade agreements, which open up export opportunities and enhance competitiveness. This market promises a positive outlook and strong growth potential in the future.

Join the Vietnam Beautycare Expo to discover the latest trends and solutions in cosmetic packaging from around the world! Don’t miss the opportunity to meet top experts and businesses in the industry, and together promote sustainable and innovative development in cosmetic packaging. Join the Vietnam Beautycare Expo today:

🌐 Exhibit Registration:https://beautycarexpo.com/en/dat-gian/

🌐 Visitor Registration: https://checkin.adpex.vn/en/exhibition/beautycare-expo-2024-hcmc

🌐 Trade Registration: https://forms.gle/C83ZxeyTc3V2TtAr8

——

Vietnam Beautycare Expo | International Exhibition on Beauty Products, Technology, and Services

🗓 September 11-14, 2024, at SECC, District 7, Ho Chi Minh City

☎ Phone: (+84) 28 3823 9052

💌 Email: beautycare@beautycarexpo.com

🌐 Website: www.beautycarexpo.com

Source: Mordor Intelligence. (n.d.). Asia-Pacific cosmetic packaging market. Retrieved July 24, 2024, from https://www.mordorintelligence.com/vi/industry-reports/asia-pacific-cosmetic-packaging-market