Industry Insights

The global perfume market size was valued at USD 31.4 billion in 2018 and is expected to expand at a CAGR of 3.9% from 2019 to 2025. The market growth is attributed to growing trend of personal grooming, coupled with increasing demand for luxury and exotic fragrances. Moreover, increasing consumer spending on premium and luxury fragrances due to high income level, along with improving living standards, is driving the global market. In recent years, perfumes have evolved into a significant business in the cosmetics and personal care industry. Perfumes have emerged as an essential product driven by growing trend of personal care, forming a part of pride and confidence.

Product diversification by manufacturers is also expected to expand the customer base. Product innovations based on customer need are further augmenting the sales in the perfume market. For instance, Lauder’s Jo Malone stores offer fragrance consultations so that shoppers can develop a customized product. Moreover, a Tokyo location of this brand had an artist placed near checkout to outline cityscapes on packaged boxes to create a unique product packaging design.

Furthermore, the company purchased the artisan perfume house By Kilian, thereby adding to its store of trendy names such as Le Labo and Editions de Parfums Frederic Malle. They offer in-store blending on customer demand with an aim to provide a premium shopping experience of hand crafted products.

Key players are also focusing on introducing natural fragrances in the premium category, primarily due to rising concerns over allergies and toxins in synthetic ingredients. Approximately 75% of millennial women prefer buying natural products, wherein more than 45% of them favor natural based healthy perfumes. For instance, LUXE brand has been positioning itself as a natural fragrance brand and is focusing on collaborating with celebrity personalities for product endorsement.

Moreover, innovative promotional activities are driving the market. Manufacturers are investing in advertisements in an effort to influence the purchase decisions. Growing influence and impact of social media and celebrity endorsements is one of the trending advertisement strategies implemented by the players.

Companies are heavily investing in their advertisements and promotions to attract consumers on digital platform. For instance, L’Oréal developed a tool named dubbed cockpit, which was designed to measure the real time ROI and productivity level of its media investments. This technology enabled better decision-making while formulating performance strategies.

In 2017, L’Oreal had spent around USD 9.2 billion on various advertisement and promotional activities, which recorded an increase of 4.9% from 2014 to 2017. These factors have been aiding the companies to understand their product performance and develop products to meet the customer needs, thereby contributing to the growth of the global market.

Report Coverage & Deliverables

Product Insights

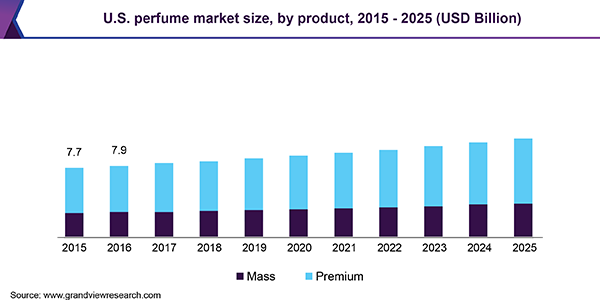

Premium perfumes accounted for the largest share of more than 65.0% in 2018. The growth has surpassed that of mass fragrance products in the last few years owing to greater emphasis on quality, personalization, and exclusivity. Premium perfumes are expected to expand at the fastest CAGR of 3.9% from 2019 to 2025 owing to growing preference for unique, hand crafted, and exotic fragrances.

Manufacturers are also focusing on widening their offerings to include the high end products. For instance, Coty has slimmed down its product portfolio of low-priced labels after the acquisition of some Procter & Gamble Co.’s beauty brands. Since then, it has been focusing on the luxury lines, which include Gucci Bloom and Tiffany & Co., targeting the millennials.

Decline in the mass perfume products is majorly attributed to increasing preference for premium fragrances among consumers. This has been driving the manufacturers to shift their focus towards premium products, thereby contributing to the growth of the global market. For instance, in 2016, sales of celebrity mass perfumes such as Britney Spears has declined by 22% in U.K., thereby driving the companies to introduce premium fragrances.

End User Insights

Women accounted for the largest share of 60.1% in 2018. It is observed that women in U.S. purchase a new perfume as often as once a month, in comparison to men who buy it on an average of 1-2 times per year, mainly for the purpose of replenishment. As per a survey, around 41% of the females in U.S. use perfumes everyday as compared to men.

In U.K., women pay more for fragrances than men, wherein female perfumes cost an average of about 6p more per ml as compared to male fragrances of the same brands. Perfume sales are expected to rise up among women irrespective of its high price points, as they consider it to be an essential part of personal care.

Distribution Channel Insights

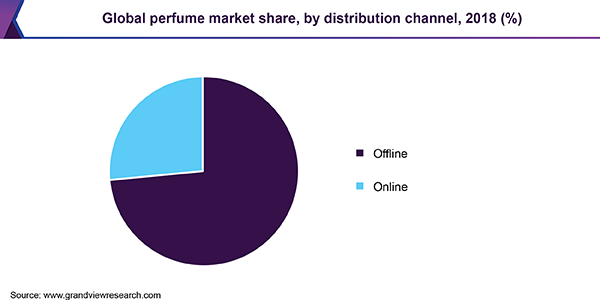

The offline channel accounted for more than 70.0% share in 2018.Consumers prefer this channel to purchase their products due to availability of a wide range of options as well as facility of scanning the product details before any purchase. The offline segment is mainly driven by the sales from specialty stores that offer premium products. The layout of the supermarket and promotional campaigns by leading brands have also increased the sales volume in the supermarket and hypermarket segment. Growth of the organized retail sectors has been driving the market by providing ample space and visibility for the existing brands to offer their products.

The online platform is expected to witness the fastest growth during the next few years. Evolution of online retail channels such as Flaconi, Amazon, and Parfumdreams has turned out to be a new and convenient way of distributing perfumes, despite consumers not being able to test the fragrance before purchase. Various modes of advertisements and promotions in the market are very prominent, thereby driving the consumers to prefer online channels.

Regional Insights

Europe, followed by North America, accounted for the largest share in 2018. The U.S. and Europe market remain the industry trendsetters. Major countries contributing to the growth of the Europe market include Germany, France, and U.K., wherein Germany accounted for 16.3% in 2018. In 2017, Coty was positioned as the leading player in the fragrance market in Germany. The market growth was attributed to the strong sales of the premium products through brands such as Jil Sander and Calvin Klein, along with new product launches from other brands such as Hugo Boss.

France accounted for 25.9% share in the regional market in 2018. France serves as the home of numerous leading perfumes brands such as Christian Dior, Chanel, and Guerlain. The country has been driving the Europe market with the highest production and export values. In 2017, France had exported about USD 4.8 billion worth fragrance products to the global market, thereby representing more than 25.0% of the world’s total perfume exports in the same year.

Perfume Market Share Insights

Some of the major players in the global market are Avon Products Inc.; Natura Cosmticos SA; Chanel SA; Coty Inc.; LVMH; L’Oreal Groupe;Estee Lauder;Elizabeth Arden, Inc.; and Puig SL. Companies such as Coty Inc.; Puig SL; LVMH; and L’Oréal have been purchasing smaller niche brands to expand their offerings in the premium category. Moreover, companies such as Unisex brand Escentric Molecules and other independent companies are developing products aiming to provide fragrances that adapt easily to consumers’ skin pH levels, thereby spurring the growth of the global market.

Report Scope

| Attribute | Details |

| Base year for estimation | 2018 |

| Actual estimates/Historical data | 2015 – 2017 |

| Forecast period | 2019 – 2025 |

| Market representation | Revenue in USD Billion & CAGR from 2019 to 2025 |

| Regional scope | North America, Europe, Asia Pacific, Central & South America & MEA |

| Country scope | U.S., U.K., Germany, France, China, and India |

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors and trends |

| 15% free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization |

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global perfume market report on the basis of product, end user, distribution channel, and region:

- Product Outlook (Revenue, USD Billion, 2015 – 2025)

- Mass

- Premium

- End User Outlook (Revenue, USD Billion, 2015 – 2025)

- Men

- Women

- Distribution Channel Outlook (Revenue, USD Billion, 2015 – 2025)

- Offline

- Online

- Regional Outlook (Revenue, USD Billion, 2015 – 2025)

- North America

- U.S.

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Central & South America

- Middle East & Africa (MEA)

- North America

Source: https://www.grandviewresearch.com