The perspective of social network users reveals new beauty needs in the context of the Covid-19 pandemic with a lot of potential for personal care and beauty brands to exploit. Join YouNet Media to review the bright spots of skin care needs in the first 6 months of 2020.

“Skin care at home” is on the throne!

Social distancing seems to have boosted consumers’ need to take care of themselves at home. According to the e-commerce report Q2/2020 by iPrice Group: the beauty and health care industry 2nd strongest growth in online categories (only after online department stores).

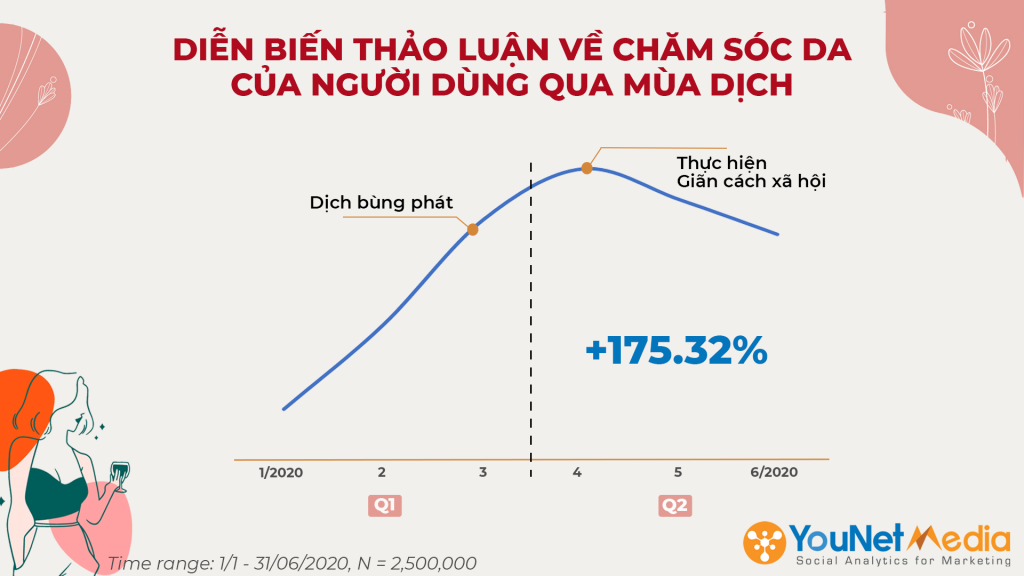

Having the same positive growth, when measuring discussion beams around skin care needs, YouNet Media found that total discussions increased by 175.32% in Q2 compared to Q1. Recorded a spike in growth in March. and recorded a peak in April, when people work from home according to the government’s social distancing regulations. This shows that social distancing is a positive bright spot for the beauty industry.

Moreover, when analyzing further into the needs of shoppers to find products through iPrice.vn: in Q2, online demand for skin care products increased sharply by 133% compared to Q1, while demand Demand for makeup products decreased by 3%.

Reflecting the changing needs of users, “skin care” is the most prominent topic on social media among consumer beauty groups. Featured as a discussion thread “home care” or “my skin care routine” or “skin care routine” accounts for 284, 987 discussion. Posts sharing their own skin care process or upgrading skin care procedures, Q&A and product reviews have recorded a large number of users’ discussion and sharing. Beauty groups such as “BEAUTY TIPS & REVIEWS♡(Vietnam)” or “Beautiful Lemongrass” or ‘Not Afraid of Ugly’ lead the way in generating discussion.

Diversity in skin care needs

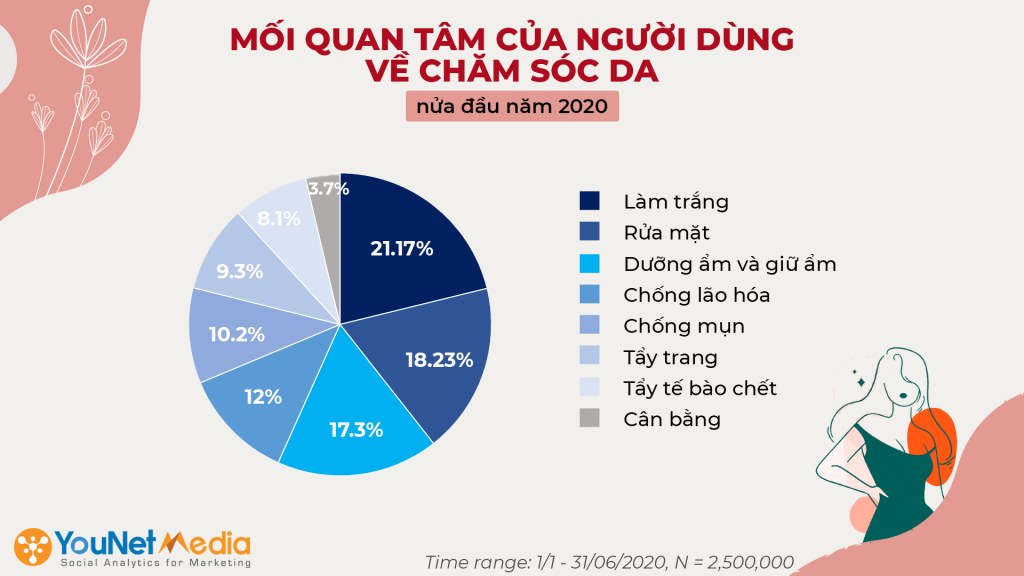

Influenced by the Korean wave of standard skin care, Vietnamese consumers have also tended to multi-step skin care with a variety of care needs. In addition to the basic needs such as cleaning, washing face (21.17% ) or the top concern about white skin (18.23%), there have appeared nutritional needs such as moisturizing, moisturizing (17.3%) or anti-aging (12%) are the main topics of user interest.

Notably, the topic of anti-aging also received discussion from young audience from 25 years old showing their awareness in taking care of their skin to have not only healthy, beautiful but also youthful skin. see users’ concerns about premature skin aging. According to iPrice.vn data also recorded in the second quarter, the demand for online anti-aging products increased 156% compared to the previous quarter.

Besides, the needs are not popular with all users such as anti-acne (10.2%); makeup remover (9.3%); exfoliating (8.1 %); skin balance (3.7%).

Moisturizing, exfoliating and makeup removal – skin care highlight for the first 6 months of the yearđầu năm

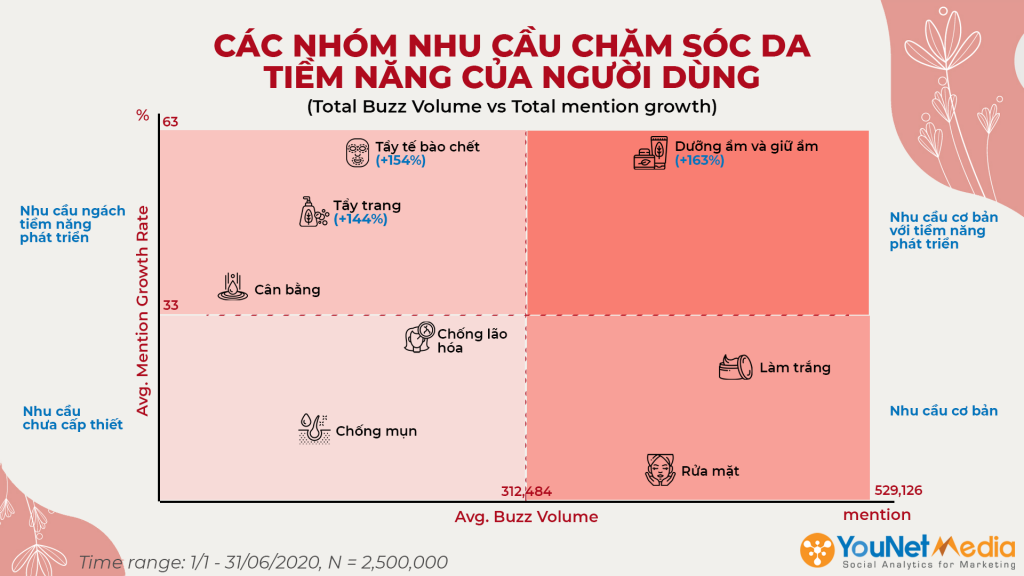

When analyzing in-depth skin care discussion beams of users in the first 6 months of 2020 under the impact of the pandemic, based on 2 criteria: discussion growth rate (Mention Growth Rate) and discussion market share (Buzz Volume) ) of each skin care need, YouNet Media found 4 groups of potential skin care needs of social network users including:

Group of basic needs: Whitening and washing face

Basic needs with growth potential: Moisturizing and Moisturizing

Niche needs with growth potential: Exfoliating, Cleansing and Balancing

The need is not urgent: Anti-aging and Anti-acne

Based on this matrix, YouNet Media recognizes 3 bright spots in users’ potential skin care needs:

Moisturizing & moisturizing – Intensive skin care

Reaching 581,400 discussion in Q2, moisturizing and moisturizing for skin has become the most noticed demand by users during the epidemic season when both growth rate and market share are large. Demand search and review for moisturizing products accounted for a large share of the discussion and a growth rate of 163%. In which, natural moisturizing products are noticed by users in the context of the desire to have healthier and more beautiful skin and towards environmental friendliness.

Besides skin care products, more intensive care products also have positive discussion growth such as masks (growth 58.5% per month); serum (growth 29.3% per month).

Exfoliate, Remove Make-up – Deep Cleansing

A demand for discussion market share is still modest but has a very fast growth rate of discussion; That’s why it is classified as a niche demand that will have the potential to grow in the near future: exfoliating, removing makeup. These are the needs that satisfy the user’s desire for more intensive cleaning.

Growth 154% discussed with 273,350 discussion, featuring a bunch of topics of safe exfoliation for each skin type that are actively reviewed and shared by users. In which, AHA or BHA chemical exfoliants have a growth rate of 15.6% discussed per month in the first 6 months of the year.

Even if the demand for makeup is no longer a top priority during the epidemic season, the demand for makeup removal still witnessed a vibrant growth when it grew to 144% discussion in Q2 with an increase of 269,750 discussion. iPrice recorded that in the second quarter, the demand for online cotton and makeup remover products increased by 341% compared to the previous quarter.

As users become aware of moisturizing and skin care, the need to find cleansing products no alcohol or fragrance to completely remove sebum and deep clean increases. Products with moisturizing and gentle for all skin types including acne or sensitive skin are also of interest to users, such as the witch hazel makeup remover line or the Micellar makeup remover line. Water.

In addition to products directly related to deep cleansing, products accompanied by face washes also recorded an average growth rate of 31.8% discussions per month.

When potential “beauty followers” become influencer marketing

Being more concerned about the origin, continuously learning information about the finished product, searching for new beauty products more in depth, approaching new trends to upgrade your skin care process and sharing beauty community or group on social media brings great attention and response from users. These consumers have a certain knowledge and passion for beauty, when they share a neutral opinion based on personal experience and normal skin condition, it should bring a great influence to other beauty believers.

This is not only a group of cosmetic consumers, but they also have the potential to become influencers for brands when their sharing affects certain groups of people in communities. And the faces of beauty bloggers like Hannah Olala, Ha Linh & Trinh Pham always appear in the brand’s campaigns, making finding new faces a challenge for brands in choosing the face to send gold to convey. message to the user.

So what factors will help guide the brand in the skincare industry?

After the pandemic, will the above trends continue after the pandemic or just temporary? Which trend is sustainable to be able to take advantage of in the future? With the characteristics of being a highly personalized industry and changing seasonal demand, brands need to pay attention to monitor potential demand and consumption habits, product use cycle of consumers to continuously Research and improve products to meet the increasingly diverse needs of consumers.

Occasion-based marketing can also be used to tap into the changing seasonal needs of consumers, especially through social media. From there, it helps to bring the brand closer to consumers by giving them a clear picture of what season and time consumers should use the brand’s products with reasons to believe (Reason to believe). persuasive and inspirational.

Besides, implementing communication and messages, listening to customer feedback as well as observing competitors on social media will also help brands be more timely when making their marketing decisions. This listening will also help brands plan and use influencers more effectively and exploit a new group of influencers – beauty followers in the future.