Vietnam Skin Care Products Market by Type (Cream, Lotion, and Others), Demographics (Male and Female), Age Group (Generation X, Millennial, and Generation Z), and Sales Channel (Supermarket/Hypermarket, Specialty Stores, Department Stores, Beauty Salons, Pharma & Drug Stores, and Online Sales Channel): Opportunity Analysis and Industry Forecast, 2021–2027

The Vietnam skin care products market size was valued at $854.3 million in 2019, and is projected to reach $1,922.4 million by 2027, registering a CAGR of 11.7% from 2021 to 2027. The skin care products market exhibits an incremental revenue opportunity of $1,154.25 million from 2020 to 2027. Skin care products refer to those products, which improve skin integrity and provide relief to skin conditions, thereby enhancing the appearance. Several types of skin care products are available in the market, which include cream, lotion, masks, and serums. These products are manufactured using chemical compounds, medicinal herbs, or natural ingredients.

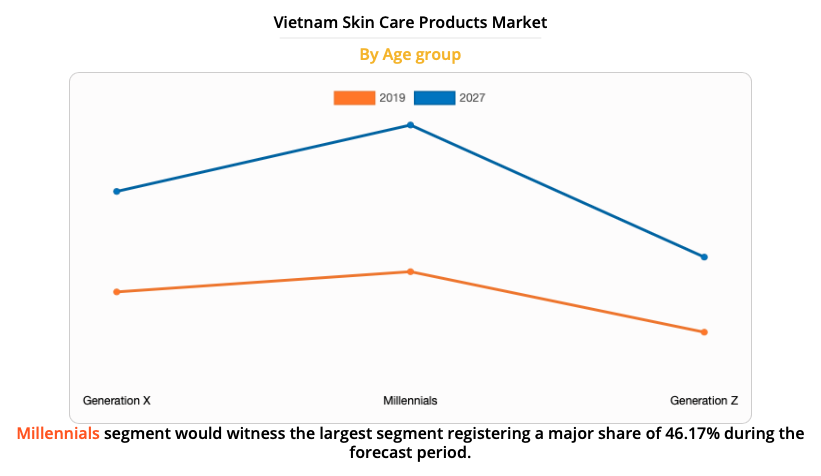

Rise in awareness regarding the benefits of self-care among consumers has propelled the adoption of organic skin care products in Vietnam. Increase in disposable income and rise in young population are the crucial factors that boost the growth for Vietnam skin care products market. Generation Z accounts for 39.08% of the total population. These consumers prefer brands that reflect their values and attitude. Skin care products have witnessed significant adoption among these consumers, as Gen Z is most easily influenced by online advertising. In addition, increase in internet penetration has positively impacted the sale of skin care products by offering multiple benefits to consumers such as heavy discounts, easy price comparisons, availability of more variety, and door step delivery. These factors collectively have led to an increased demand for skin care products among consumers in the country.

However, rise in penetration of counterfeit products and surge in preference toward advanced beauty treatment such as microdermabrasion, laser resurfacing, laser skin rejuvenation, acne blue light therapy, and Thermage restrict the Vietnam skin care products market growth. On the contrary, increase in preference for domestic brands among Vietnam consumers can be regarded as opportunities by skin care manufactures to further expand their consumer base.

According to Vietnam skin care products market analysis, the market is segmented on the basis of product type, demographics, age group, and sales channel. By type, it is categorized into cream, lotion and others. Depending on demographics, it is bifurcated into male and female. On the basis of age group, it is classified into generation X, millennial, and generation Z. As per sales channel, it is fragmented into supermarket/hypermarket, specialty stores, department stores, beauty salons, pharma & drug stores, and online sales channel.

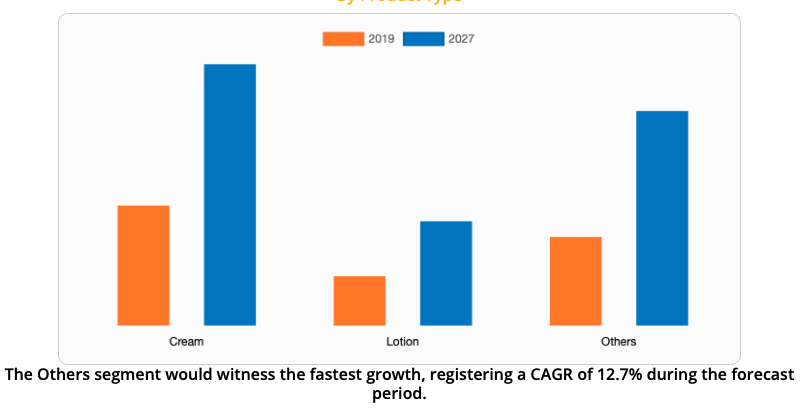

On the basis of type, the cream segment accounted for the maximum Vietnam skin care products market share in 2019, since cream and cream-based products are regarded as one of the most popular skin care products in Vietnam. Consumers in the country are adopting various skin care products due to increase in consciousness regarding appearance and well-being. In addition, the adoption of skin care cream has augmented among generation Z, owing to its varied benefits that help improve the skin tone and texture. To cater to the ever-changing needs of customers, key players are focusing on R&D activities to introduce a novel product line in the skin care products market. These companies are further investing in packaging and marketing activities to gain maximum visibility among consumers. Lacvert Sensitive Skin, ISA KNOX White Focus Clear Whitening, and Clarins Gentle Care are some of the popular cream products in the country.

Vietnam Skin Care Products Market

By Product Type

On the basis of type, the cream segment accounted for the maximum Vietnam skin care products market share in 2019, since cream and cream-based products are regarded as one of the most popular skin care products in Vietnam. Consumers in the country are adopting various skin care products due to increase in consciousness regarding appearance and well-being. In addition, the adoption of skin care cream has augmented among generation Z, owing to its varied benefits that help improve the skin tone and texture. To cater to the ever-changing needs of customers, key players are focusing on R&D activities to introduce a novel product line in the skin care products market. These companies are further investing in packaging and marketing activities to gain maximum visibility among consumers. Lacvert Sensitive Skin, ISA KNOX White Focus Clear Whitening, and Clarins Gentle Care are some of the popular cream products in the country.

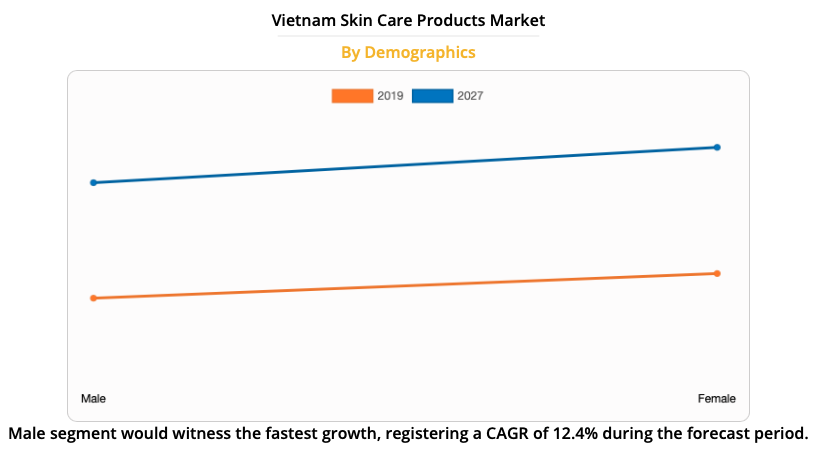

By demographics, the female segment was dominant, which accounted for more than half of the share in market in 2019, and is expected to continue this trend during the Vietnam skin care products market forecast period. The female population in Vietnam is around 49.87% of the total population. Surge in urban women population in Vietnam and increase in need to maintain basic personal hygiene have augmented the sale of skin care products. Several other factors such as increase in female labor force and rise in awareness regarding maintaining prolonged beauty have significantly contributed toward the growth of the overall market.

Depending on age group, the millennial segment held a significant share in the Vietnam skin care products market in 2019, as millennial in the country are not only conscious about their health and fitness but are also much less materialistic than other generations, i.e., caring more for a worthwhile experience than a tangible product. Moreover, they are known to be more tech-savvy and exhibit interest in trying new products, which make them the key target audience.

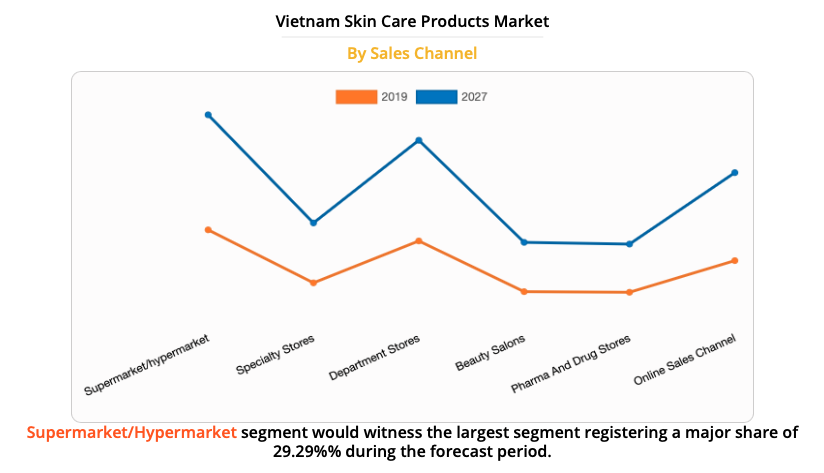

As per sales channel, the supermarket/hypermarket segment held a significant share in the Vietnam market in 2019, owing to increase in benefits offered by it such as discounts and availability of optimum options for cosmetics products. Around 90% of cosmetics products are imported in Vietnam. Foreign brands sell their products through distributors and supermarket/hypermarket. Supermarkets/hypermarkets have gained high popularity, owing to availability of a broad range of consumer goods, ample parking space, and convenient operation timings. Availability of cosmetics in supermarket/hypermarket provides increased accessibility to consumers of multiple cosmetic brands. Moreover, these serve as one-stop solution, which makes them a popular option of shopping. Some of the major supermarkets/hypermarket in the country are Fivimart supermarket, Intimex supermarket, Metro supermarket, and Big C supermarket.

The players in Vietnam skin care products market have adopted new product launch as their key developmental strategy to expand their market share, increase profitability, and remain competitive in the market. The key players operating in Vietnam skin care products industry includes L’Oréal Group, the Procter & Gamble Company, Unilever PLC, Bejesdorf AG, Estee Lauder Companies Inc., Shiseido Company Limited, Saigon Cosmetics Corporation, and Marico.

source:https://www.alliedmarketresearch.com/vietnam-skin-care-products-market-A06729